Get used to reviewing the business's pricing strategy and assess what will happen to the overall rise in selling price.Ģ. There are several ways to improve their inventory turnover rate as follows:ġ.

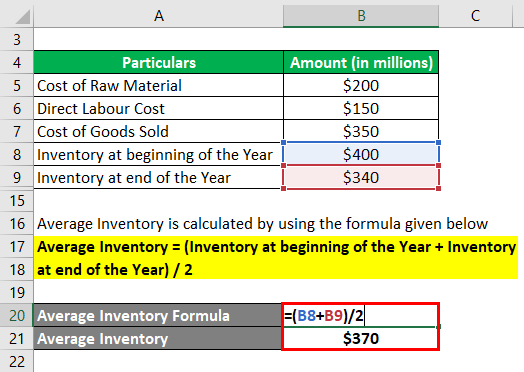

It is imperative to remember to compare companies within the same sector and find out a trend of the last few years. As a rule of thumb the higher the inventory turnover ratio, the better it is. There is no ideal figure and it depends on the industry standards. A very high ratio may reveal a shortage of working capital and a low inventory level of a company. A very lower ratio indicates unnecessary blockage of working capital.Ī higher inventory turnover ratio shows inventory or stock has sold out rapidly and inventory management is more efficient. A lower ratio shows the company is not marketing its product efficiently or if a low inventory turnover ratio is due to excessive inventory at the end of the year, then the company is incurring a high cost to maintain the inventory. The inventory turns is an activity ratio that measures the efficiency of the management regarding inventory management and the latitude of the rapidity of movement of inventory for a specific period.Ī lower inventory turnover ratio indicates weak sales and high inventory. The inventory days is 82 means ABC company can sell its inventory within 82 days of production.Īs a rule of thumb, the lower the number of days taken for the company to sell its inventory, the better is its efficiency.Ī lower number indicates the company to sell its inventory soon. Inventory Days = (365 / Inventory Turnover Ratio) The inventory days helps to calculate the number of days taken by the company to sell its inventory. What are the differences between inventory days and inventory turnover? Inventory turnover of 4.45 means that ABC company can sell its inventory about 4.45 times during the year. The average inventory formula is given below:Īverage Inventory = (Opening Inventory + Closing Inventory) / 2 Inventory Turnover Example Average inventory calculated on a monthly or quarterly basis. It takes into account the opening inventory and closing inventory of the same year. Cost of Goods Sold Formula = Opening stock + Purchase - Closing stock Average InventoryĪverage inventory is the average cost set of goods between two or more specified periods. Cost of Goods Sold Formula = Sales - Gross ProfitĢ. There are two ways we could calculate the cost of goods sold as follows.ġ. The COGS is reported on the income statement of a company. It includes direct materials, direct labours or factory overhead which are directly connected with the production of the good. The cost of goods sold or COGS is a cost incurred from directly manufacturing a product. Inventory Turnover Ratio = (Cost of Goods Sold / Average Inventory) Cost of Good Sold The inventory turnover ratio formula is calculated by dividing the cost of goods sold by average inventory. It is also known as the inventory turnover ratio that establishes a relation between the cost of goods sold and average inventory. Planning for fixing different inventory levels can be made by the management of a company with the help of this ratio. The liquidity positions of a company can be tested through this ratio. The inventory turnover is an activity ratio and also called a 'stock turnover ratio' that shows the number of times a company has sold and replaced its inventory in a year. If you do not properly maintain the inventory turn ratio, you will have to face trouble in the future such as not paying lenders, suppliers and overhead costs etc. If you have a business that can be big or tiny, you must maintain an inventory turnover ratio for growing your business.

0 kommentar(er)

0 kommentar(er)